Chapter 2 Planning and coordination

2.1 Introduction

2.1 Changes in the classification of goods and services may require reviewing and updating the sample of goods and services for the CPI, adjustment of compilation systems in terms of aggregation and linking of CPI series based on the old and the new classifications, and consultation with stakeholders and user groups. Hence, the implementation of classification changes requires careful and long-term planning. The same classification of goods and services, e.g., COICOP or a similar national or regional classification, may be used for other statistics, including household budget surveys (HBSs), national accounts, Purchasing Power Parities (PPPs) and money-metric poverty measurement. The change in the classification therefore should also be coordinated with other statistical domains that use the same or a similar classification.

2.2 Since data from the HBS are used as inputs in the production of other statistics, the HBS ideally is the first statistics in which the new classification should be implemented. Section 2.2 explains the central importance of the HBS in the plan to introduce the new classification. The use of the classification by different statistical domains and the importance of coordination between them is discussed in section 2.3. Section 2.4 presents and elaborates each of the steps and the associated timing, required to implement a new classification. Finally, Section 2.5 summarises the key points of the chapter.

2.2 Household budget survey

2.3 The HBS, or similar household income and expenditure surveys, provides estimates of household consumption and expenditure, in addition to a variety of other metrics. In almost all countries the HBS provides the underlying data to determine the CPI elementary indices and their weights. The HBS is also used for the national accounts compilation of household final consumption expenditure (HFCE). This is important for the CPI as many countries use national accounts estimates or growth rates for the CPI weights (or use these in combination with HBS and other data sources). The HBS therefore affects the CPI via the national accounts.

2.4 The HBS is designed to record the expenditures of each sampled household. The results should report weighted aggregate expenditure over a 12-month period. A key challenge when designing the HBS questionnaire is to define the list of items for which the respondent should report their expenditure. These items should be organised according to the classification of goods and services.

2.5 COICOP18 contains a more detailed classification hierarchy compared to COICOP99, with a new 5-digit level and an optional 6-digit level for food. This additional detail facilitates the choice of the list of products for the HBS. However, some subclasses are still too generic to be understood by households and may need to be elaborated with further detail. Each country needs to customize the list of products. This detailed customised list should be coded within the classification structure. Three main considerations should inform the list of products in HBS questionnaires – coverage of the classification, sufficient detail to facilitate households understanding, and limiting the statistical burden on the households.

2.6 When considering the introduction of a new classification, the development of the HBS questionnaire should be carried out in cooperation between the HBS team and CPI, PPPs, national accounts and poverty estimation experts. The HBS should be fully coded in the agreed classification. This will facilitate the use of the HBS results by the CPI and other users.

2.3 Other usage of classifications in the statistical system

2.7 Individual expenditure classifications are used by the national accounts to record HFCE by product group at a certain level of detail. A close alignment between the classification used in the national accounts and the CPI will assist with the deflation of these expenditures to obtain real estimates of this component of GDP. In many countries, the weights of the CPI are updated using the change in the annual HFCE at the product level. The use of the same classification system will enable a smooth annual weights update.

2.8 Money-metric poverty measures are used to set national poverty lines, determine the cost of basic needs, and estimate the share of the population living at different levels of poverty. Selected expenditure groups are used to calculate the poverty lines. CPI indices are used to adjust poverty measures in years when fresh expenditure data from an HBS is not available.

2.9 The International Comparison Programme (ICP) compiles Purchasing Power Parity (PPP) ratios for countries using CPI and GDP data. The PPP results therefore also depend on an aligned classification structure.

2.4 Steps to implement a change in classification

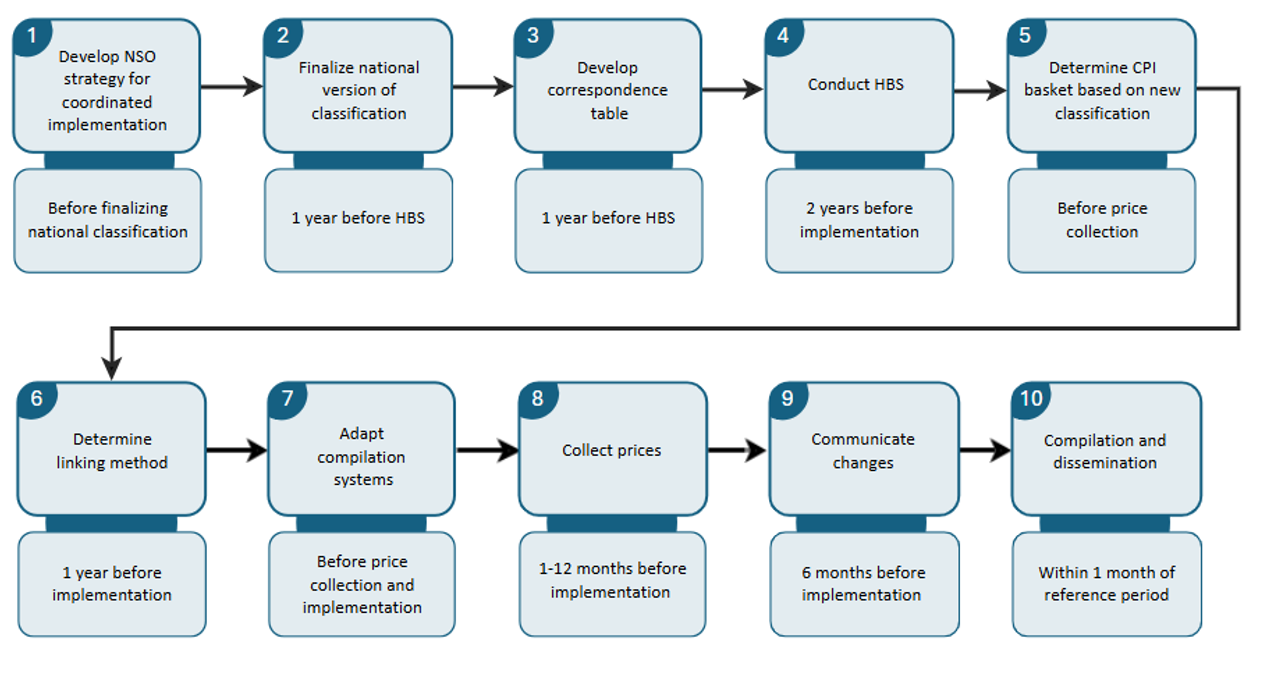

2.10 A generic set of activities is laid out in this section to guide detailed implementation planning. Figure 1 sets out the main steps and proposed timing. It illustrates that planning should begin more than three years before the intended implementation date. The suggested timeframes are not prescriptive. Depending on national circumstances, it may be possible to carry out some of the activities in parallel.

Figure 1 Steps to implement a new classification

1. Develop NSO strategy for coordinated implementation

2.11 Prior to the actual implementation of the new classification in the CPI following the steps below, the NSO should develop an overall strategy for implementing the changes across the statistical domains that use it. The strategy could cover the steps outlined here but also explain the implementation process in the national accounts, PPPs and poverty estimates. Developing a strategic-level document can promote awareness and organisational cooperation for the changes. The NSO should also ensure sufficient resources are made available to support the successful implementation of the new classification.

2. Finalize national version of the classification

2.12 The first step to the implementation of a new classification in the CPI is to agree on a national version of the classification. The international standard of COICOP18 extends to a 5-digit subclass for all categories and an optional 6-digit for food items. Expenditure estimates from the HBS and CPI elementary indices are usually computed in more detail such as an 8-digit level. The detailed classification levels should especially elaborate on those categories in which national consumption patterns are concentrated.

2.13 Some countries may decide to deviate from the standard COICOP classification to account for certain national particularities in consumption behaviour or to reduce the impact of the changes from previous national customizations. The extension and adaptation of the classification should be undertaken by a team with representatives from each of the units mentioned earlier.

3. Develop correspondence table

2.14 Once the classification detail is finalised, it should be mapped to the existing classification. This correspondence table is central to the successful implementation of the new classification and is covered in Chapter 3. These two activities should take place at least one year before the HBS to ensure enough time for planning the HBS.

4. Conduct HBS

2.15 The HBS is usually conducted over a 12-month period and further time is required for editing and weighting the data. CPI compilers should be aware of the HBS project timelines when planning the date for implementing the change in classification. Sufficient time is required for all the subsequent steps to be completed before disseminating the updated CPI. Fieldwork for the HBS, using the new classification, should begin two years before the implementation of the new classification in CPI.

5. Determine CPI basket based on new classification

2.16 The CPI basket is the list of representative items included in the CPI. The classification determines the structure of this basket. Chapter 3 of the CPI Manual provides guidance on the selection and weighting of the basket. While the HBS is the basis of selecting the elementary indices, other data sources, such as the national accounts or retail sales information might also be used. In these cases, the additional data sets will need to be coded to the new classification. The list of elementary indices must be finalized before price collection for new products begins (2.20).

6. Determine the linking method

2.17 The approach to linking indices compiled using the old and new classifications is discussed in detail in Chapter 4 of the Guide. A key issue is whether the component time series will be revised or not. This decision has significant planning implications for changing compilation systems and communicating to users in time. Consequently, the decision on linking should be made well ahead of when the actual activity should take place, preferably about 1 year before implementation. Ideally, the change in classification should be implemented together with an update of the weights and a possible update of the index reference period of the CPI.

7. Adapt compilation systems

2.18 Changing classifications has a substantial effect on compilation systems. Most countries have compilation systems for data collection, editing and index compilation. The systems contain information for each sampled price observation and use codes that are typically based on the CPI classification. Depending on whether the NSO uses the long-term or short-term price relative, variety level codes will need to be changed at a minimum for a month prior to introduction (if using the short-term approach) and to the price reference period (if using the long-term approach). It is key that the programmes maintain the like-on-like/matched model comparisons to correctly calculate average price changes.

2.19 Similarly, the codes for elementary indexes, together with their aggregations will change. This will affect programmes used for index compilation through to the publication of the monthly (or quarterly) CPI. Depending on the decisions made on how to link in indices compiled according to COCIOP18, the compilation systems will need to facilitate the computation of indices for a number of years back.

8. Collect prices

2.20 The CPI basket that emerges following the HBS may require the initiation of new products for price collection. Some NSOs use 12 months as the price reference period, and others use a single month or a quarter. In cases where a full year is used, prices need to be collected for this whole period. However, where the reference period is one month or quarter, prices are required only for a shorter period of time. Either way, sufficient time should be provided for training price collectors to collect the new products.

9. Communicate changes

2.21 Communication to stakeholders should occur at least 6 months before the dissemination of the reclassified CPI figures, in line with international statistical quality frameworks. Consultation with key users either bilaterally or through advisory committees can guide the NSO on key messages as well as material needed by users to aid the transition. Chapter 5 of this guideline provides details on the communication processes. In some cases, if a change in classification or method used in CPI compilation is significant, the NSO may wish to consider a counterfactual calculation (i.e. CPI compiled on the old and new basis) to provide users with a quantifiable indication of the magnitude and direction of any difference in the CPI.

10. Compilation and dissemination

2.22 The final step to implement the new classification is the compilation of the CPI results and publication. Given the extent of the changes, it is advisable to provide more time than usual to compile the indices and prepare the publication. Additional explanations to users should accompany the publication.

2.5 Key points

Planning for the implementation of the new classification should take place several years before the intended implementation date and should be sufficiently resourced.

Planning and implementation should include all users of the classification within the NSO.

The household budget survey is the ideal vehicle to begin implementation as it forms the basis of the CPI basket and weights.

The Guide proposes 10 steps to consider when planning the implementation of classification changes. The steps and the timing should be adapted to national circumstances.