Chapter 19 Economy

1213.

1213. Statistics on the economic characteristics of persons are needed from population censuses for many reasons. Information on the productive activities of persons is vital to establish a comprehensive picture of the economic structure of a country, and the work patterns, labour market participation and extent of labour underutilization of its population. This information, when combined with other personal, household and dwelling characteristics collected in the census, enable assessments of the socio-economic situation of persons and households, which are essential to inform the formulation and planning of a wide range of economic and social policies and programmes related to employment creation, poverty reduction, work-life balance, vocational education and training, provision of social security and other social benefits, gender equality and social inclusion.

1214.

1214. Such statistics can be obtained from a traditional census or other sources such as household-based surveys, business surveys or administrative data sources. These other sources can have certain limitations. Household surveys, especially labour force surveys, are particularly well suited for generating a broad range of statistics on the economic characteristics of the population at aggregate levels, such as national and broad regional groupings. Data obtained from labour force surveys, however, are subject to sampling error and therefore, rarely provide reliable estimates for small areas, small population groups, or detailed groups of industries and occupations. In contrast population censuses can provide certain core statistics at the lowest levels of aggregation for such small population groups and for detailed occupation and industry groups. Administrative data sources e.g. may have good quality of occupational and industry coding. However, they may not have the same comprehensiveness in population activity coverage, excluding productive activities that are informal or unpaid.

1215.

1215. The population census also provides benchmark information to which statistics from other sources can be related. Population censuses, either traditional censuses or based on administrative data sources, likewise provide sample frames for most household-based surveys, including labour force surveys.

1216.

1216. In the UNECE region a growing number of countries are deriving census information on economic characteristics from administrative data sources. For international comparability, it is recommended that countries provide accurate and detailed information on the sources, definitions and methodology that are used.

1217.

1217. In deciding which topics relating to the economic characteristics to include in the population census, countries should assess the existence of other sources of the statistics and their complementary uses, as well as take into accounts what is relevant for national purposes. The aim should be to cover core topics needed as benchmark information for the preparation of sample frames, and to provide essential statistics for small areas and small population groups, and for small occupation and industry groups, as relevant in the national context.

1218.

1218. International resolutions and guidelines to produce statistics relating to the economic characteristics of the population are adopted by the International Conference of Labour Statisticians (ICLS) and endorsed by the Governing Body of the International Labour Organization (ILO).108 Recommendations on topics amenable for inclusion in population censuses are discussed in general in Box 7.

Box 7

New international recommendations concerning statistics of work, employment and labour underutilization

New international recommendations concerning statistics of work, employment and labour underutilization

In October 2013, the Nineteenth International Conference of Labour Statisticians (ICLS) adopted the Resolution concerning statistics of work, employment and labour underutilization.109 This Resolution replaced the previous international recommendations relating to the measurement of the economically active population, employment, unemployment and underemployment dating from 1982 (13th ICLS) and related guidelines.

These new standards adopted at the 19th ICLS introduced a number of important revisions, among which are: a conceptual framework for work statistics consistent with the System of National Accounts; guidelines for separately measuring different forms of work, including a more targeted definition of employment as “work for pay or profit”, and for expanding the range of measures of labour underutilization beyond the traditional unemployment. New terminology was also introduced, as relevant, and terms considered to be out-of-date, particularly the “economically active/inactive population” were replaced with “labour force/ outside the labour force”.

Important elements from the 13th ICLS resolution of the economically active population, employment, unemployment and underemployment essential to the internal consistency of the statistics remain unchanged. The refinements of the definition of employment and introduction of measures of labour underutilization may result, however, in breaks in the historical series of statistics of the economically active population, employment, unemployment and underemployment. In particular, productive activities carried out without pay, such as those listed below, are no longer included within the scope of employment:

Production of goods intended for own final use by the household;

Unpaid work by apprentices, interns and trainees;

Organization‐based volunteer work;

Direct volunteering to produce goods for other households.

Participation in these activities is now to be measured separately through the defined forms of work identified as: own‐use production work, unpaid trainee work and volunteer work, respectively.

Countries are encouraged to develop their statistical system to cover work statistics, including statistics on the labour force, based on their specific national needs and resources. In the case of the measures affected by the 19th ICLS Resolution it is of utmost importance that the institutions and persons responsible for planning and managing the production of statistics on the economic characteristics of the population develop a strategic and coordinated approach that takes into account all official sources of the statistics, including the population census, labour force survey and other household-based surveys and administrative records. Data users will need to be kept well informed of the process, including by widely disseminating the relevant metadata and by maintaining parallel series for a specified period following their implementation.

19.2.1 Work

19.2.1 Work

1219.

1219. Measurement of the economic characteristics of the population is based on the conceptual framework for work statistics (see Box 7). In this framework, work is defined for reference purposes as “any activity performed by persons of any sex and age to produce goods or to provide services for use by others or for own use”.

1220.

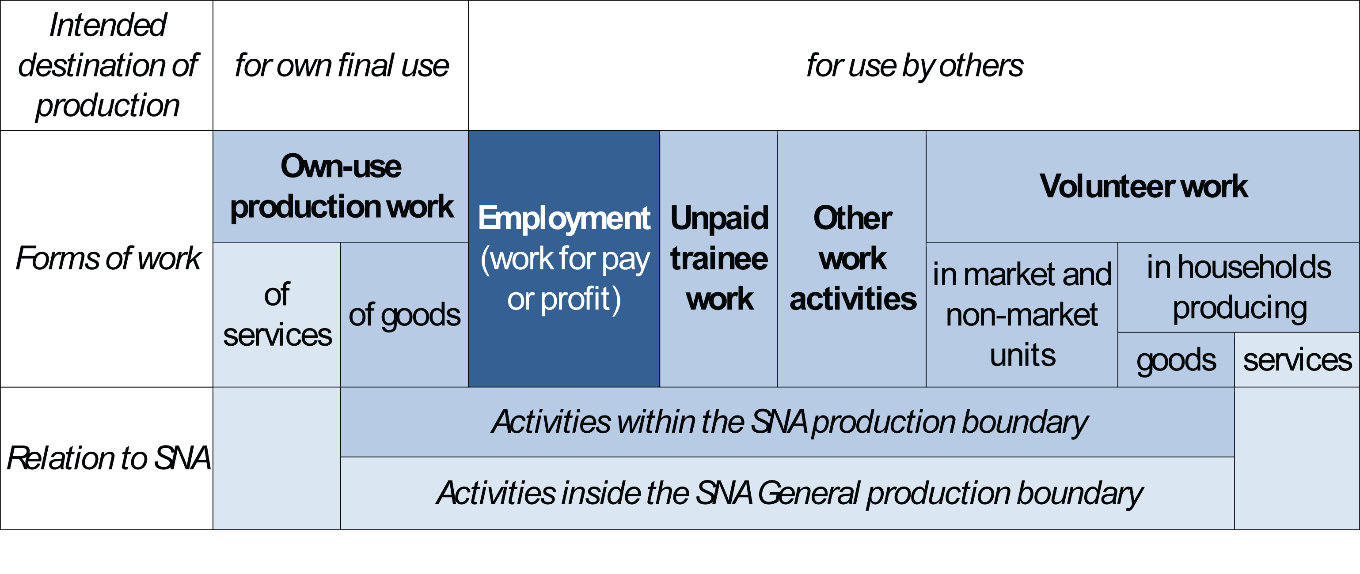

1220. The integrated framework of the System of National Accounts110 confines the concept of labour input to the input to the production activities within the SNA production boundary, although in the extended accounts on unpaid household service work a broader concept of production is applied. On the other hand, the various forms of work identified in the 19th ICLS Resolution concerning statistics of work, employment and labour underutilization, as presented in Figure 7, can be aligned to either the general production boundary, when all forms of work are included, or the SNA production boundary, when direct volunteer work providing services and the production of services by households for own final use are excluded. Exceptions are owner-occupied housing services and the production of domestic and personal services by employing paid domestic staff. In this respect, it is worth noting that activities may move in and out the SNA production boundary. For example, due to digitalisation, one can observe changes from households buying services from travel agencies to arranging travel themselves, or using the services provided by supermarkets to using self-service checkouts. On the other hand, one can observe a trend of purchasing services which were traditionally produced by households themselves, e.g., using the services of kindergartens instead of taking care of children at home. Whatever the case, there is a clear link between what is defined as production in the SNA and the notion of labour.

1221.

1221. The conceptual framework for work statistics identifies five mutually exclusive forms of work (type of productive activity) for separate measurement, see Figure 7. These forms of work are distinguished on the basis of the intended destination of the production for own final use; or for the use of others, i.e. other economic units, and the nature of the transaction i.e. monetary or non-monetary transactions and transfers, as follows:

(a) “Own-use production work”, comprising production of goods and services for own final use;

(b) “Employment work”, comprising work performed for others for pay or profit;

(c) “Unpaid trainee work”, comprising work performed for others without pay to acquire workplace experience or skills;

(d) “Volunteer work”, comprising non-compulsory work performed for others without pay;

(e) “Other work activities”, including activities as unpaid community service and work by prisoners, when ordered by a court or similar authority, and unpaid military or alternative civilian service, which may be treated as a distinct form of work for measurement (such as compulsory work performed without pay for others).

Figure 7

Forms of work and the System of National Accounts

Forms of work and the System of National Accounts

Source: Diagram 1 in the Resolution to amend the 19th ICLS resolution concerning statistics of work, employment and labour underutilization. Report of the Conference – 21st International Conference of Labour Statisticians. Appendix 2, Resolution II. Geneva: International Labour Office, 2024.

1222.

1222. During a given reference period, persons may engage in one or more forms of work in parallel or consecutively, that is, persons may be employed, volunteering, doing unpaid trainee work or producing for own final use, in any combination.

1223.

1223. To meet different objectives, countries may measure the economic characteristics of the population in the census with respect to their participation in one or in several forms of work. In particular, this may include measurement of:

(a) “Persons in employment” is essential as part of the preparation of labour force statistics that include unemployment and other measures of labour underutilization. It is needed to assess the labour market participation of the population, and to classify the population according to their labour force status in a short reference period (see section 19.3);

(b) “Persons in own-use production of goods” is especially important in countries where particular groups of the population engage in agriculture, fishing or hunting and gathering for own final consumption, including for subsistence (see section 19.5), and to enable integration of the population census with the agricultural census (see Chapter 20);

(c) “Persons in unpaid trainee work” may be advisable where unpaid apprenticeships, internships and traineeships may be a main mechanism of labour market entry for particular groups such as youths or for specific occupations such as mechanics or tailors, given their small size and limited availability of alternative statistical sources.

1224.

1224. Given the need for detailed probing, the measurement of participation in own-use provision of services, unpaid trainee work and volunteer work is more appropriate through household surveys or, if desired, through the census by means of a long form applied to a sub-set of the population.111

1225.

1225. Additional information may also be collected in the population census in order to classify the population according to their main form of work based on self-declaration, in a short or long reference period.

19.2.2 Working time

19.2.2 Working time

1226.

1226. The concept of working time comprises the time associated with productive or work activities and the arrangement of this during a specified reference period.112 Working time relates to each form of work.

1227.

1227. The number of persons engaged in a given form of work provides only a very rough estimate of the volume of work performed, particularly when the work is performed on a part-time, casual or occasional basis. Information on working time is necessary to prepare estimates of the volume of work or labour input for the national accounts. It is also essential to support the design, monitoring and evaluation of economic, social and labour market policies and programmes targeting labour market flexibility, work-life balance and conditions of work, including situations of underemployment due to insufficient working time (that is, time-related underemployment) and of excessive working time.

1228.

1228. The population census can provide information on the hours usually worked and hours actually worked (see definitions in paragraphs 1299 and 1300). Where the census is the only available data source it may as a minimum incorporate a single question on hours usually worked for persons in employment and for persons in own-use production of goods, as relevant (see paragraph 1308). The inclusion of hours usually worked can be useful for countries concerned about the relevance for some users of the one-hour criterion in the definition of employment.

19.2.3 Population coverage and age limits

19.2.3 Population coverage and age limits

1229.

1229. Information on the economic characteristics of the population should in principle cover the entire population, regardless of country origin, citizenship or geographic location of their place of work. In practice, a lower age limit is usually set in accordance with the conditions in the country.113 For compiling child labour statistics, the relevant international standards identify the target population as all persons in the age group from 5 to 17 years.114 Countries in which many children participate in employment or in other forms of work, including in agriculture, will need to select a lower minimum age than countries where work of children is uncommon. Census tabulations of economic characteristics should at least distinguish between persons under 15 years of age and those 15 years of age and over.

1230.

1230. In general, an upper age limit for measurement of economic characteristics of the population is not recommended, so as to permit comprehensive coverage of work activities of the adult population and to examine transition between employment and retirement. Many people continue to be engaged in different forms of work beyond retirement age and the numbers involved are likely to increase as a result of factors associated with the ageing of populations. Countries may, however, wish to balance the cost of collecting and processing information relating to the productive activities of older persons (e.g. those aged 75 years or more) and the additional response burden imposed on them against the significance and reliability of the information provided.

1231.

1232.

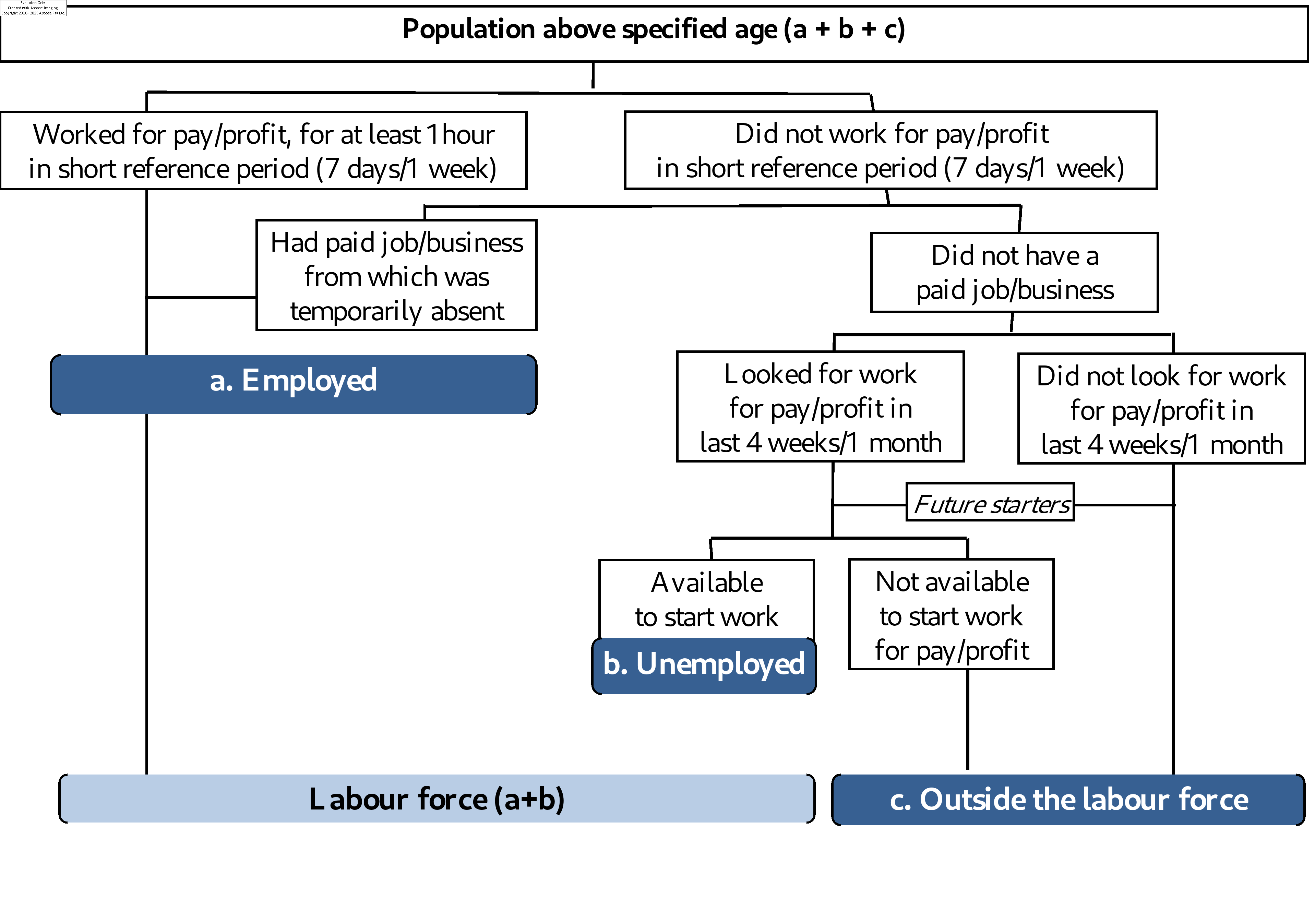

1232. A classification of persons by their labour force status provides important information about their relation to the labour market, in particular to work for pay or profit, in a short reference period. The three categories of labour force status, i.e. employed, unemployed or outside the labour market, are mutually exclusive and exhaustive. While even during a short period persons may be engaged in multiple activities, to establish their labour force status, priority is given to employment over the other forms of work and over unemployment; and to unemployment over outside the labour force, see Figure 8. Thus, for example:

(a) A volunteer worker who also has a part-time employee job should be classified as employed;

(b) A person growing crops for own final use and who is also seeking and available for employment should be classified as unemployed; and

(c) A person who has a part-time job, working only a few hours for pay and who is also seeking another job, should be classified as employed.

1233.

1233. The sum of persons in employment plus persons in unemployment comprises the labour force, see Figure 8.115

1234.

1234. The labour force status of persons is established with regards to a short reference period of seven days or one week, which may be the last seven days prior to the specified census day, the last completed calendar week, or a specified recent fixed week. For comparability purposes, it is particularly useful to apply a short-reference period with the same total duration (such as a reference week) for the census as for the national labour force survey, if any. This short reference period serves to provide a snap-shot picture of labour market participation in the country around the time of the census. As such, the labour force, that is, persons in employment plus persons in unemployment, reflects the supply of labour for the production of goods and services in exchange for pay or profit at a specified point in time. Seasonal variations in employment and unemployment levels, which may be significant both in industrialized and in developing economies, will not be captured. Assessments of such temporal variations in work patterns are more adequately captured through sub-annual household surveys (for example monthly, quarterly).

1235.

1235. If probing questions in an interview or using detailed questions in a self-administered census questionnaire, the determination of the labour force status of a person may be influenced by respondents’ or enumerators’ subjective understanding of the concepts of employment and unemployment. In this regard, particular attention should be given to special groups for which the determination of the labour force status may be difficult, e.g. youths, women and elderly persons after the normal age of retirement, and those working as contributing family members. To reduce underreporting, enumerators need to be explicitly instructed, or the questionnaires specifically designed.

1236.

1236. Given the importance of reliable data on labour force status, serious consideration should be given to minimizing classification errors.

Figure 8

Classification of working age population by labour force status

Classification of working age population by labour force status

19.3.1 Employed persons

19.3.1 Employed persons

1237.

1237. Employed persons are all those above the specified age who, during a short reference period of seven days or one week, were engaged in any activity to produce goods or provide services for pay or profit. The notion “for pay or profit” refers to work done as part of a transaction in exchange for remuneration payable in the form of wages or salaries for time worked or work done or in the form of profits derived through market transactions from the goods and services produced. It includes remuneration in cash or in kind, whether actually received or not, payable directly to the person performing the work or indirectly to a household or family member.

1238.

1238. Two categories of persons in employment are:

(a) Employed persons “at work,” that is, who worked for pay or profit for at least one hour; and

(b) Employed persons “not at work” due to working-time arrangements (such as shift work, flexitime and compensatory leave for overtime) or to a “temporary absence” from a job for pay or profit.

1239.

1239. Use of the one-hour criterion serves to ensure coverage of all types of job, including part-time, temporary or casual jobs, thereby supporting identification of all persons in employment and analysis of their working conditions. This is also a prerequisite for the consistency of employment statistics with national accounts data on production.

1240.

1240. Persons on “temporary absence” from a job, including as employees or self-employed should be considered in employment, provided that they were “not at work” for a short duration and maintained a job attachment during the absence. The existence of a job attachment should be established on the basis of the reason for the absence and, in the case of certain reasons, the continued receipt of remuneration or the total duration of the absence (in general not more than three months116). Reasons for absence include:

(a) Those where job attachment is generally maintained, and thus, do not require further probing, such as sick leave due to own illness or injury (included occupational); public holidays, vacation or annual leave; and periods of maternity or paternity leave as specified by legislation; and

(b) Those requiring further assessment of continued receipt of remuneration or total duration including parental leave, educational leave, care for others, other personal absences, strikes or lockouts, reduction in economic activity (for example temporary lay-off, slack work), disorganization or suspension of work (for example due to bad weather, mechanical, electrical or communication breakdown, problems with Information and Communication Technology (ICT), and shortage of raw materials or fuels).

19.3.1.1 Treatment of specific groups

19.3.1.1 Treatment of specific groups

1241.

1241. According to international standards, the following groups of persons should be classified as in employment, see 19th ICLS (International Conference of Labour Statisticians):

(a) Persons with a job for pay or profit who, during the reference period were on training or skills-enhancement activities required by their job or for another job in the same economic unit;

(b) Apprentices, interns and trainees who receive remuneration in cash or in kind;

(c) Persons who work for pay or profit through employment promotion programmes;

(d) Persons who work for their own economic units to produce goods mainly for sale or barter, even if part of the output is consumed by the household or family;

(e) Persons with seasonal jobs during the off-season, if they continue to perform some tasks and duties for the job, excluding, however, the fulfilment of legal or administrative obligations (for example, pay taxes);

(f) Persons who either work in a market unit operated by a family member living in the same or in another household (that is, contributing family workers) or perform tasks or duties of an employee job held by a family member living in the same or in another household;

(g) Regular members of the armed forces and persons on military or alternative civilian service who perform this work for pay in cash or in kind.117

1242.

1242. Excluded from employment are:

(a) Apprentices, interns and trainees who work without pay in cash or in kind (that is, persons engaged in unpaid trainee work);

(b) Participants in skills training or retraining schemes within employment promotion programmes, when not engaged in the production process of an economic unit;

(c) Persons who are required to perform work as a condition of continued receipt of a government social benefit such as unemployment insurance;

(d) Persons with seasonal jobs during the off season, if they cease to perform the tasks and duties of the job;

(f) Persons on indefinite lay-off who do not have an assurance of return to employment with the same economic unit;

(g) Persons who work to produce goods intended mainly or exclusively for consumption or use by the household or family, even if a surplus or part of the output is sold or bartered (that is, own-use production of goods, see section 19.5);

(h) Household members who provide unpaid services for consumption or use by their household (that is, own-use provision of services);

(i) Persons who work voluntarily and without pay to produce goods or services through or for other economic units, including market, non-market units and households (that is, volunteer work).

1243.

1243. Information should be given in the census reports describing how the above-mentioned groups and other relevant groups were treated.

19.3.2 Unemployed persons

19.3.2 Unemployed persons

1244.

1244. Unemployed persons are all those above the specified age who (a) were not in employment, (b) carried out activities to seek employment during a specified recent period and (c) were currently available to take up employment given a job opportunity.

1245.

1245. To be classified as unemployed, a person must satisfy all of the three criteria, where:

(a) “Not in employment” (that is, not engaged in work for pay or profit) is assessed with respect to the short reference period for the measurement of employment as defined in paragraph 1237;

(b) To “seek employment” refers to any activity, when carried out during a specified recent period comprising the last four weeks prior to enumeration or calendar month, for the purpose of finding a job or setting up a business or agricultural undertaking. This includes also part-time, informal, temporary, seasonal or casual employment, paid apprenticeships, internships or traineeships, within the national territory or abroad. Examples of such activities are:

i. Arranging for financial resources;

ii. Applying for permits or licences;

iii. Looking for land, premises, machinery, supplies or farming inputs;

iv. Seeking the assistance of friends, relatives or other types of intermediaries;

v. Registering with, or contacting, public or private employment services;

vi. Applying to employers directly, or checking at worksites, farms, factory gates, markets or other assembly places;

vii. Placing or answering, newspaper or online job advertisements; and

viii. Placing or updating résumés on professional or social networking sites online;

(c) “Currently available” serves as a test of readiness to start a job in the present, assessed with respect to the same short reference period that is used to measure employment. Depending on national circumstances, the reference period may be extended to include a short subsequent period not exceeding two weeks in total, so as to ensure adequate coverage of unemployment situations among different population groups.118

1246.

1246. Unemployment has been one of the most widely used measures of labour underutilization. However, it only captures persons in situations of complete lack of work for pay or profit, and where opportunities for job search exist. In circumstances where there are few channels for seeking employment or where labour markets are limited in scope, or when labour absorption is inadequate, unemployment will not capture fully all persons with an unmet need for employment. Separate identification of underutilized persons (included in the potential labour force, see paragraph 1252) supports better assessment of the different types of underutilization affecting labour markets across settings, and more targeted policymaking.

1247.

1247. It may be useful to distinguish first-time jobseekers, who have never worked before, from other jobseekers in the classification of the unemployed. To do so, however, may require an additional question regarding previous work experience, which may impose too much of a burden for a population census.

19.3.2.1 Treatment of specific groups

19.3.2.1 Treatment of specific groups

1248.

1248. Also classified as unemployed according to international standards are:

(a) Future starters, defined as persons “not in employment” and “currently available” who did not “seek employment” because they had already made arrangements to start a job within a short subsequent period, set according to the general length of waiting time for starting a new job in the national context but generally not greater than three months);

(b) Participants in skills training or retraining schemes, within employment promotion programmes, who on that basis were “not in employment”, not “currently available”, and did not “seek employment” because they had a job offer to start within a short subsequent period generally not greater than three months;

(c) Persons “not in employment” who carried out activities to migrate abroad in order to work for pay or profit but who were still waiting for the opportunity to leave;

(d) In accordance with the priority rules to establish their labour force status, persons who during the reference period were mainly students, homemakers, pensioners, registered unemployed or engaged in forms of work other than employment (for example, own-use production work, volunteer work) and who at the same time were “not in employment”, carried out activities to “seek employment” and were “currently available”, as defined above, should be classified in unemployment. Information should be given in the census reports on how persons in these and other specific groups were treated.

19.3.3 Persons outside the labour force

19.3.3 Persons outside the labour force

1249.

1249. Persons outside the labour force comprise all those in the working-age population, who in the short reference period were neither employed nor unemployed as defined above, including persons below the minimum age specified for the collection of economic characteristics.

1250.

1250. Different classifications of persons outside the labour force may be used for analytical purposes. Particularly useful for informing labour market and social policies and programmes are classifications by degree of labour market attachment and by main reason for not entering the labour force. These alternative classifications can be derived from the same questions used to identify the unemployed and may be used separately or in combination to enable further analysis.

1251.

1251. Persons outside the labour force may be classified by the degree of labour market attachment into the following groups:

(a) Unavailable jobseekers, that is, those “seeking employment” but not “currently available”;

(b) Available potential jobseekers, that is, those not “seeking employment” but “currently available”;

(c) Willing non-jobseekers, that is, those neither “seeking employment” nor “currently available” but who want employment;

(d) Others, that is, persons neither “seeking employment” nor “currently available” who do not want employment.

1252.

1252. The classification of persons outside the labour force by degree of labour market attachment allows identification of the potential labour force, computed as the sum of (a) unavailable jobseekers plus (b) available potential job seekers. Together with unemployment, the potential labour force is a key measure of labour underutilization. It is relevant both in more and less developed settings, especially

(a) Where the conventional means of seeking employment are of limited relevance;

(b) Where the labour market is largely unorganized or of limited scope;

(c) When labour absorption is, at the time, inadequate; or

(d) Where persons are largely self-employed.

1253.

1253. Although not a part of the potential labour force, the group (c), willing non-jobseekers represents a group of persons outside the labour force with an expressed interest in employment and is particularly relevant for social and gender analysis in specific contexts.

1254.

1254. Persons outside the labour force may also be classified by their main activity or reason for not entering the labour market. Some persons may be classifiable in more than one category. In such situations, priority should be given to the possible categories in the following order:

(a) Attending an educational institution’ refers to persons outside the labour force, who attended any regular educational institution, public or private, for systematic instruction at any level of education, or were on temporary absence from the institution for relevant reasons corresponding to those specified for employed persons “not at work”.

(b) “Performing unpaid household services” refers to persons outside the labour force engaged in the unpaid provision of services for their own household, such as spouses and other relatives responsible for the care and management of the home, children and elderly people. Domestic and personal services provided by domestic employees working for pay in somebody else’s home are considered as employed in line with the definition of employed persons.

(c) “Retiring on pension or capital income” refers to persons outside the labour force who receive income from property or investments, interests, rents, royalties or pensions from former employment.

(d) “Other reasons” refer to all persons outside the labour force who do not fall into any of the above categories, for example, children not attending school, those receiving public aid or private support and persons with disabilities unable to work.

1255.

1255. Additional reasons for not entering the labour force that are considered particularly important at national or regional level, such as “engaged in own-use production of goods” should also be taken into account in the classification of population outside the labour force.

1256.

1256. Once the labour force status of persons has been established, additional important topics regarding the labour market participation of the population relate to the characteristics of their jobs and of the establishments in which they work. These include, in particular, status in employment, occupation, place of work, industry, institutional sector, working time and income.

1257.

1257. A job is defined as the set of tasks and duties performed or meant to be performed by one person for a single economic unit. Person may have one or several jobs during the reference period. The main job is that with the longest hours usually worked even if the employed person was not at work in the reference period.

1258.

1258. Job-related characteristics are generally collected in reference to the main job for a person in employment and may also be collected in reference to the last main job (if any) for persons not in employment. This allows for classification of the labour force and of persons outside the labour force by characteristics of their (last) main job. Once the (last) main job is identified, it is essential that all subsequent questions refer to that same job, even if the respondent was not at work in the reference period. The census questionnaire or the census information taken from registers/administrative records should be designed in a way that will ensure that the variables “status in employment”, “occupation”, “industry” and “institutional sector” are measured for the same job.

1259.

1259. The collection of data on characteristics of the last main job of unemployed persons, especially occupation, industry and status in employment, may be useful in order to inform policies aimed at promoting employability and job creation. To serve this purpose, it is recommended to set a time limit for past employment experience (for example, during the last five or ten years) and only collect information on the characteristics of the last main job if it was held within the time limit.

1260.

1260. When secondary jobs held in the reference period are also identified, the questionnaire should be designed so as to enable clear and separate identification of characteristics relating to main and secondary jobs. Identification of secondary jobs is particularly important in countries where multiple job holding is commonplace, particularly in agriculture, and when collecting information on income from employment and working time, in order to support analysis of the relationship between employment, income and poverty.

19.4.1 Status in employment (core topic)

19.4.1 Status in employment (core topic)

1261.

1261. Status in employment refers to the type of explicit or implicit contract of employment with other persons or organizations that the employed person has in their job. The basic criteria used to define the groups of the classification are; the type of economic risk, to which the worker may be exposed to the loss of financial or other resources in pursuance of the activity and the unreliability of remuneration; and the type of authority over the organization of the work and over the economic unit for which the work is performed. Care should be taken to ensure that an employed person is classified by status in employment on the basis of the same job used for classifying the person by “occupation”, “industry” and “sector”.

1262.

1262. With the adoption of the 20th ICLS Resolution concerning statistics on work relationship119 a new classification of status in employment ICSE-18 was introduced. ICSE-18 includes ten detailed categories of status in employment that all jobs can be categorized in thus creating the opportunity to provide a more detailed picture of the different work relationships.

1263.

1263. One significant change with ICSE-18 is that these ten categories also can be organized in two ways: ICSE-18 according to the type of authority (ICSE-18-A) and ICSE-18 according to the type of economic risk (ICSE-18-R).

1264.

1264. When organized by authority, ICSE-18 distinguishes between independent workers and dependent workers, making it useful for various types of labour market analysis such as the impact of economic cycles and government policies. When organized by economic risk, it categorizes workers into those employed for profit and those employed for pay. This hierarchy is typically preferred for national accounts, identifying wage employment, and producing statistics on wages, earnings and labour costs.

1265.

1265. Identifying the ten detailed categories in ICSE-18 may require additional questions to correctly identify them. Accordingly, it will be important to balance the benefits of providing detailed statistics with the extra burden and cost of including these questions in a census. A recommended approach to minimize burden and costs while still obtaining key statistics is to limit the identification of ICSE-18 to selected aggregated categories. This includes identifying employers, independent workers without employees, and contributing family workers, as defined by ICSE-18 based on authority.

1266.

1266. The most recent international standard is ICSE-18-A (employment categories based on authority), which is as follows:

Independent workers

(1.0) Employers

(1.1) Employers in corporations

(1.2) Employers in household market enterprises

(2.0) Independent workers without employees

(2.1) Owner-operators of corporations without employees

(2.2) Own-account workers in households and market enterprises without employees

Dependent workers

(3.0) Dependent contractors

(4.0) Employees

(4.1) Permanent employees

(4.2) Fixed-term employees

(4.3) Short-term and casual employees

(4.4) Paid apprentices, trainees and interns

(5.0) Contributing family workers

1267.

1267. Employers are persons who operate their own business on their own or in partnership with others and who employ one or more persons as employees on a regular basis. In case there is a need to test the regularity of the employee, this should be understood as having at least one employee during the reference period and at least two of the three weeks immediately preceding the reference period, even if one or more employees were engaged only for a short period. ICSE-18 distinguishes between two types of employers: employers in corporations and employers in household market enterprises.

1268.

1268. An independent worker without employees is a person who operates a business alone or with partners but does not hire anyone regularly, except themselves, their partners and contributing family workers. This category corresponds to “own-account worker” in ICSE93.

1269.

1269. Employers and independent workers without employees can, if feasible and relevant, be further categorized based on whether they operate a corporation or a household market, leading to the identification of the detailed categories: employers in corporations, employers in household market enterprises, owner-operators of corporations without employees and own-account workers in household market enterprises without employees. This would require determining if the enterprise is incorporated.

1270.

1270. Dependent contractors are persons whose activities depend on another entity that exercise operational and/or economic control over the activities. They are not employees of that entity as they have a commercial agreement but are dependent on that unit for organization and execution of the work, income, or for access to the market. By definition, dependent contractors lack regular employees and do not own or operate an incorporated enterprise. Dependent contractors are a new category in ICSE-18, sharing characteristics of both independent workers and employees.

1271.

1271. The separate identification of dependent contractors typically requires additional questions to establish whether there is a dependent relationship and if control is exercised. In a Census, this might not be relevant unless there is a strong national need.

1272.

1272. If deemed relevant to distinguish dependent contractors from independent workers or employees, a minimized approach in a Census, or in a more suitable source as the Labour Force Survey, could be used to get a broad estimation of the share of dependent contractors in the country. The measurement should be restricted to non-employees with commercial agreements that do not have regular employees and do not own an incorporated enterprise, focusing on identifying whether these persons have a main client or an intermediary client that sets the price for the goods and services produced.120

1273.

1273. An employee is a person who is in employment for pay, on a formal or informal basis, and who do not hold controlling ownership of the unit (enterprise, a non-profit institution, government unit or household) in which they are employed.

1274.

1274. ICSE-18 provides for detailed categories of employees: Permanent employees, fixed-term employees, Short-term and causal employees and Paid apprentices, trainees and interns. If feasible and relevant these four detailed groups can be identified by establishing whether the employee has a permanent agreement until retirement (or until further notice) or a fixed-term agreement, and whether the fixed term-agreement is less than three months or three months or more. Paid apprentices, trainees and interns are employees who work to acquire workplace experience or skills in a trade or profession and receive payment in return for work performed. They can potentially be identified separately through a pre-coded category.

1275.

1275. Contributing family workers are persons who assist a family member or a household member in a market-oriented enterprise operated by the family or household member. They do not receive regular payments, such as a wage or salary, in return for the work performed, but may receive some irregular payment. They do not make the most important decisions affecting the enterprise or have responsibility for it.

1276.

1276. Member of a producers' cooperative do no longer constitute a status in employment category. In general, members of a producers’ cooperative are to be considered independent workers in ICSE-18 but may under some circumstances be regarded as dependent contractors if they depend significantly on the cooperative in terms of access to market, organization of pricing of the work and fulfil the criteria to be classified as dependent contractors.

1277.

1277. Seasonal workers, domestic workers, home-based workers and workers in multi-party work relationships (including agency workers, and employees providing outsourced services) are according to the Resolution concerning statistics on work relationships so called cross-cutting categories as these would be groups that consists of several different status in employment categories.121

1278.

1278. When members of the armed forces paid in cash or in kind are counted among the employed, they should be included in the category of employees. However, because of the wide range of national practices in the treatment of the armed forces, it is recommended that census tabulations and related notes provide an explicit indication of the status in employment category in which they are included.

1279.

1279. The treatment of additional groups such as work gang (crew) members, franchises, sharecroppers, communal resource exploiters, workers in cooperatives, outworkers and crowd workers can be found in the conceptual framework for Statistics on Work relationships as these groups are no longer addressed explicitly in the Resolution.

1280.

1280. In most census questionnaires, the information concerning status in employment will be captured through pre-coded alternatives where only a few words can be used to convey the intended meaning of each category. This may mean that classification of some of the situations on the borderline between two or more categories will be carried out according to the subjective understanding of the respondent rather than according to the intended distinction. This should be kept in mind in designing the questionnaire and also when presenting the resulting statistics.

1281.

1281. Countries that rely on the direct use of administrative records for the classification of persons according to status in employment, may find that e.g. the group contributing family workers and dependent contractors cannot be separately identified. Those who would have been classified to this group when using a questionnaire may either be classified as part of one of the other groups or in the case of contributing family members, excluded from persons in employment. One possibility for countries relying on administrative records to better integrate ICSE-18 is to use ICSE-18-R, with the employment categories based on risk. If using ICSE-18-R, it is recommended that data for at least two main categories (1) “Workers in employment for profit” and (2) “Workers in employment for pay”, should be separately tabulated, and data on employees should be identified.

1282.

1282. Activities in areas such as agriculture, fishing, hunting and gathering intended mainly for own consumption by the household are not considered employment and therefore not to be included in ICSE-18. Instead, participation in these productive activities is to be measured through the separate concept of own-use production of goods (see section 19.5) and categorized according to the International Classification of Status at Work (ICSaW-18).122 Countries relying on administrative data sources in their census will typically lack information on participation in own-use production of goods and are recommended to survey this specifically, e.g. in the Labour Force Survey (see paragraph 1307).

19.4.2 Occupation (core topic)

19.4.2 Occupation (core topic)

1283.

1283. Occupation refers to the type of work done in the main job by the person employed (or the type of work done in the last job held if the person is unemployed), irrespective of the industry or the status in employment in which the person’s job is classified. The type of work is considered in terms of the main tasks and duties performed in the job.

1284.

1284. For purposes of international comparison, it is recommended that countries make it possible to prepare tabulations in accordance with the latest revision of the International Standard Classification of Occupations (ISCO). An updated Standard is expected in 2028. At the time the present set of census recommendations was approved the latest revision was the one adopted by a Tripartite Meeting of Experts in Labour Statistics in 2007 and endorsed by the Governing Body of the International Labour Organization (ILO) in 2008 and known as ISCO-08.123

1285.

1285. Countries coding occupation according to a national standard classification should establish correspondence with ISCO either through double coding or through mapping from the detailed groups of the national classification to ISCO.

1286.

1286. Countries should code the collected occupational data at the lowest possible level of ISCO or a related national classification supported by the information given in each response. In order to facilitate detailed and accurate coding, it could be useful for the census questionnaire to ask each employed person for both the occupational title and a brief description of the main tasks and duties performed in the job. Information provided in response to the industry questions (see section 19.4.3) may also be used to assist in the coding of occupation data.

19.4.3 Industry (core topic)

19.4.3 Industry (core topic)

1287.

1287. Industry (branch of economic activity) refers to the kind of production or activity of the establishment or similar unit in which the main job(s) of the employed person was located during the time reference period established for data collection on economic characteristics.124

1288.

1288. For purposes of international comparisons, it is recommended that countries compile information on industry according to the latest revision of the International Standard Industrial Classification of All Economic Activities (ISIC).125 Countries belonging to the European Economic Area should refer to the latest version of the Statistical Classification of Economic Activities in the European Community (NACE). Countries coding industry according to a national standard classification should establish correspondence with ISIC either through double coding or through mapping from the detailed groups of the national classification to ISIC.

1289.

1289. It is recommended that the name and address of the establishment should also be collected, see also paragraph 1293. Countries with business registers that are complete and up to date can then use this response as a link to the register in order to obtain the industry code given there to the establishment.

1290.

1290. In preparation for the coding of the industry responses that cannot be matched to a pre-coded register, the organization responsible for the census should create a coding index that reflects the type of responses that will be given on the census questionnaire.

19.4.4 Type of workplace (non-core topic)

19.4.4 Type of workplace (non-core topic)

1291.

1291. Two main topics related to the place of work of persons in employment are the type of workplace and its geographic location. The type of workplace refers to the nature of the place where the person performed their main job and distinguishes between the home and other workplaces, whether fixed or otherwise.

1292.

1292. Three main categories, or a variation based on national circumstances, are recommended for classifying the type of workplace:

(a) Work at home; This category includes those who perform the tasks and duties of their main job from within the home, such as farmers who work and live on their farms, homeworkers including persons teleworking from own home, self-employed persons operating (work)shops or offices inside their own homes, and persons working and living at work camps;

(b) No fixed place of work; This category should be restricted to persons who, in performing the tasks and duties of their main job, travel in different areas and who do not report daily in person to a fixed address as a work base, for example, travelling salespersons, long-distance commercial vehicle drivers, seafarers, fishers and own-account taxi drivers. It also includes ambulant vendors, operators of street or market stalls that are removed at the end of the workday, construction workers working at different sites during the reference period and push-cart operators;

(c) With a fixed place of work outside the home; All other persons in employment should be included in this category, including persons who move around in their job but have a fixed-base location to which they report daily, such as bus and taxi drivers (with a base), train and airline staff, and operators of street and market stalls that are not removed at the end of each workday. This group may also include individuals who travel to work, on a regular basis, across the national border to a neighbouring country. Fixed place of work outside the home includes: client’s or employer’s home; employer’s workplace or site; own business premises; or client’s workplace or site.

1293.

1293. The geographic location of the place of work can provide useful information for planning when used together with information on place of residence. To this end, countries may collect, for employed persons with a fixed place of work outside the home, information on the local of place of work (see section 13.10) or the reporting place during the reference period.

1294.

1294. It is likely that for some jobs, performance is at more than one location (for example, at home some of the time or season and in a fixed location outside the home at other times) or the category cannot be clearly distinguished. This may be the case for persons teleworking from own home, a group which is growing in many countries, and, thus, of special interest to stakeholders. One approach would be to select the place where the individual spends or spent a major part of his or her working time. However, if deemed relevant for countries, separate identification of such groups may be preferred. For countries using registers as the main source in the Census, the type of workplace will not be possible to identify. Questions on workplace would often be more suitable in surveys as the Labour Force Survey (LFS).

1295.

1295. Additional questions may also be asked on the method of travel to work in order to produce statistics on travel-to-work patterns, valuable as basis for transportation planning. Persons not travelling to work should be classified as “no travel to work”.

19.4.5 Institutional sector of employment (non-core topic)

19.4.5 Institutional sector of employment (non-core topic)

1296.

1296. The institutional sector of employment relates to the legal organization and the principal functions, behaviour and objectives of the enterprise with which a job is associated.

1297.

1297. Following the definitions provided in the most recent version of the System of National Accounts,126 distinction should be made between the following institutional sectors:

(a) Corporations, comprising non-financial and financial corporations (incorporated enterprises, private and public companies, joint-stock companies, limited liability companies, etc.) as well as quasi-corporations and non-profit institutions (hospitals, schools s etc. that charge fees to cover their current production costs);

(b) General government, comprising central, state and local government units together with social security funds imposed or controlled by those units, and non-profit institutions engaged in non-market production controlled and financed by government, or by social security funds;

(c) Non-profit institutions serving households (for example religious institutions, professional societies, sports and cultural clubs, charitable institutions, aid agencies) that provide goods or services to households (free or at prices that are not economically significant) and whose main resources are for voluntary contributions;

(d) Households, defined for the purposes of economic characteristics as a natural person or group of natural persons who share the same living accommodation, who pool some, or all, of their income and wealth and who consume certain types of goods and services collectively, mainly housing and food. Institutional households (section 16.2.1) also belong to the household sector. Households may engage in production activities and the household sector include unincorporated market enterprises for the purpose of producing goods or services for sale or barter on the marked.

19.4.6 Working time (non-core topic)

19.4.6 Working time (non-core topic)

1298.

1298. Information on two distinct concepts of working time can be collected in a population census: hours actually worked, and hours usually worked.

1299.

1299. Hours actually worked is defined as the time spent in a job for the performance of activities that contribute to the production of goods and services during a specified reference period. It covers the time spent in “direct hours”, in “related hours”, “down time” and short “resting time”. “Direct hours” is the time spent carrying out the tasks and duties of the job – and may be performed in any location. “Related hours”, while not leading directly to goods produced or services provided, is the time spent maintaining, facilitating or enhancing productive activities, including upkeep of the workplace, changing time or decontamination of work clothes, purchasing or transporting materials, waiting for business, customers or patients, on-call duties, travelling between work locations, and work training or skills enhancement required by the economic unit. In practice, “down time” includes unavoidable, temporary interruptions to work (for example machinery or Internet breakdown, lack of supplies). “Resting time” is inactive time for short rest or refreshment in the course of performing job-related activities, (for example coffee breaks). Longer breaks for meals, time spent not working because of vacation, holidays, sickness, industrial disputes, commuting to work (if not also performing job tasks or duties) and educational leave even if paid, are excluded from hours actually worked.

1300.

1300. Hours usually worked is defined as the typical value of the hours actually worked in a job per short reference period (for example one week) over a long observation period (month, quarter, season, year) that comprises the short reference period itself. This “typical value” of time worked during a normal or typical week may be the modal number of the hours actually worked in the short period as distributed over the long period. This would include overtime hours regularly worked whether paid or unpaid. Days and hours not usually worked and unusual periods of overtime are not included.

1301.

1301. The inclusion of hours usually worked can be useful for countries concerned about the relevance for some users of the one-hour criterion in the definition of employment. For countries relying on registers, it is also useful to have an alternative source for hours worked for persons in own-use production, see paragraph 1228.

19.4.7 Income (non-core topic)

19.4.7 Income (non-core topic)

1302.

1302. Countries may wish to collect information on the amounts of income received by individual persons or households during a specified reference period, from any source. If this topic is included in the census, it is recommended that data be obtained from all persons above a specified age, whether they are employed or not. Income should be measured at the household level, or for each individual in the household.

1303.

1303. Income may be defined as all receipts whether monetary or in kind (goods and services) that are received by the household or by individual members of the household at annual or more frequent intervals but excluding windfall gains and other such irregular and typically one-time receipts. Household income covers:

(a) Income from employment (both paid and self-employment);

(b) Income from the production of goods for own final use;

(c) Income from the provision of household services for own final use;

(d) Property income;

(e) Current transfers received.127

1304.

1304. The collection of reliable data on household income, especially income from self-employment and property income, is extremely difficult in general field inquiries, particularly population censuses. The inclusion of non-cash income further compounds the difficulties. Collection of household income in a census, even when confined to cash income, presents special problems in terms of burden of work, response errors and so forth. Therefore, this topic is considered more suitable in a sample survey of households or from administrative data such as tax or social security records. Depending on the national requirements, countries may nonetheless wish to obtain limited information on personal or household income, by covering only some of the income components (such as, income from employment), for shorter reference period (such as one month), and restricted only to cash income. As thus defined, the information collected can provide some input into statistics that have many important uses.

1305.

1305. According to international standards on the subject, the income from employment of employed persons should include wages and salaries of employees, income of members from producers' cooperatives and the mixed income of employers and own-account workers operating business and unincorporated enterprises. In addition to the income from employment of employed household members, the total income of the household should include, for example, the interest, dividends, rent, social security benefits, pensions and life insurance annuity benefits of all its members. The Handbook on Household Income Statistics provides further guidance on concepts and methods related to this topic.128

1306.

1306. The concepts involved in determining income are not simple to grasp and respondents may be unable or unwilling to provide exact information. For example, income should include social security, pension fund contributions and direct taxes withheld from employees' salaries, but some persons will undoubtedly not include these amounts in reporting their salaries. Significant items of total household income may also be excluded or misstated. Despite instructions given to enumerators, the data collected can therefore be expected to be approximate. Accordingly, in the presentation of results it is usually appropriate to use broad income or earnings size-classes. As an aid to the interpretation of the results, tabulations of the data should be accompanied by a description of the items of income assumed to be included and, if possible, an estimate of the accuracy of the figures.

1307.

1307. In some countries the production of goods for own final use (such as foodstuffs from agriculture, fishing, hunting and gathering, water, firewood and other household goods) represents an important component of the livelihood of a part of the population. If relevant in the county, collecting information in the population census on the number of persons engaged in this form of work (own-use production of goods was previously included within the concept of employment) should be considered regardless of whether this is the main or a secondary activity of a person. Such information is essential for benchmarking purposes, especially where household surveys are not frequent, for comprehensive sectoral analysis particularly of work in agriculture, forestry and fishing, and to enable integration between the population census and the agricultural census. Countries relying on administrative data sources in their census will lack information on participation in own-use production of goods and are recommended to survey this specifically, e.g. in the Labour Force Survey.

1308.

1308. Persons in own-use production of goods are all those above the specified age who, during a specified reference period, performed any activity to produce goods for own final use. The notion “for own final use” is interpreted as production where the intended destination of the output is mainly for final use by the producer in the form of capital formation, or final consumption by household members, or by family members living in other households.

1309.

1309. According to the international standards, any activity to produce goods (within the SNA production boundary) covers work performed for at least one hour in the following activities, when the intended destination of the output is mainly for own final use, as specified above:

(a) Producing and/or processing for storage agricultural, fishing, hunting and gathering products;

(b) Collecting and/or processing for storage mining and forestry products, including firewood and other fuels;

(c) Fetching water from natural and other sources;

(d) Manufacturing household goods (such as furniture, textiles, clothing, footwear, pottery or other durables, including boats and canoes);

(e) Building, or effecting major repairs to, one’s own dwelling, farm buildings, etc.

1310.

1310. For measurement purposes, the intended destination of the output is established in reference to the specific goods produced, based on self-declaration (that is, mainly for own final use). In the case of goods from agriculture, fishing, hunting or gathering intended mainly for own consumption, a part or surplus may nevertheless be sold or bartered.

1311.

1311. Persons may engage in own-use production of goods as a main secondary activity, throughout the year on a seasonal basis. To ensure complete coverage, the census questions on participation in own-use production of goods should be applied to all persons above a specified age for collecting information on the economic characteristics of the population, irrespective of their labour force status. The reference period may refer to the last 12 months, calendar year, agricultural year or season, as relevant to national circumstances. Where pertinent, the choice of reference period should promote coherence with the agricultural census.

1312.

1312. For assessments of the volume of work performed by persons in own-use production of goods, particularly when using a long reference period, it may be useful to collect information on working time, in particular hours usually worked (see paragraph 1228), or on broad categories such as part-time or full-time, part-time year or full-time year, numbers of months, as feasible and relevant to the main uses of the statistics.

1313.

1313. Informal employment is defined as any activity of persons to produce goods or provide services for pay or profit that is – in law or in practice – not covered by formal arrangements such as commercial laws, procedures to report economic activities, income taxation, labour legislation and social security laws and regulations. Informal employment includes the activities carried out in relation to an informal job, creating a link between the definition of an informal job and the definition of informal employment. Persons holding informal jobs includes independent workers (employers and own account workers) that owns and operates an informal enterprise, and dependent workers whose job do not have a formal status in relation to the legal administrative framework or whose activities are not effectively covered by formal arrangements. The operational definition of informal and formal jobs thus depends on the persons status in employment category, holding the specific job.

1314.

1314. Informal employment is a non-core topic defined in the Resolution concerning statistics on the informal economy, adopted at the 21st International Conference of Labour Statisticians in October 2023. The Resolution replaces the two preceding standards, which separately defined the informal sector and informal employment.129 It encompasses a comprehensive statistical framework for the informal economy, incorporating conceptual and operational definitions for its various statistical components, including the informal sector and informal employment. Administrative data sources will typically exclude productive activities that are not covered by formal arrangements (see paragraph 1214). The measurement of participation in informal employment will often be more appropriate to collect through household surveys.

1315.

1315. As several criteria are applied for defining informal and formal jobs it would be a need to limit the criteria used to reduce the response burden, if measured in a census.